Business Funding Strategy

Funding Strategy and Planning (Specially focused on Business Funding)

The OP CorpBanking's Advisory team shall:

Design with company representatives the financial strategy for Business Funding attending to business projects, goals and present financial situation. (It includes revision of the Financial Model).

Design with company representatives the financial strategy for Business Funding attending to business projects, goals and present financial situation. (It includes revision of the Financial Model).- Propose new sources of funding, through financial institutions not present in its banking current relations. These funding sources are formulated as stable funding lines

- Apply its expertise in the document formulation for Funding Dossier to introduce the financial reality of the company attending to Financial Intitutions and Inverstors requirements.

- At the option of the company, OP CorpBanking will support the company from the initial development, applying its experienced in negotiating with external suppliers (both, present and new sources of funding), up to its final signature.

Targets Bank Strategic Planning

- Growth and stability of bank credit lines.

- Increasing flexibility of financial instruments (quality improvement) in terms of direct improvement of credit lines limits and negotiation power with present financial suppliers.

- Reduction of collaterals or, where appropriate, maximizing credit earned through them.

- Improving the banking number and / or quality-stability of the bank-company business relation.

- Reduction and / or control of economic conditions of credit lines and services.

Most common situations requiring Business Funding Strategy:

- Predictable financial crisis situation (liquidity crisis)

- Funding of revenue growth of the company.

- Investments financing of Assets and / or M & A

- Real global crisis funding.

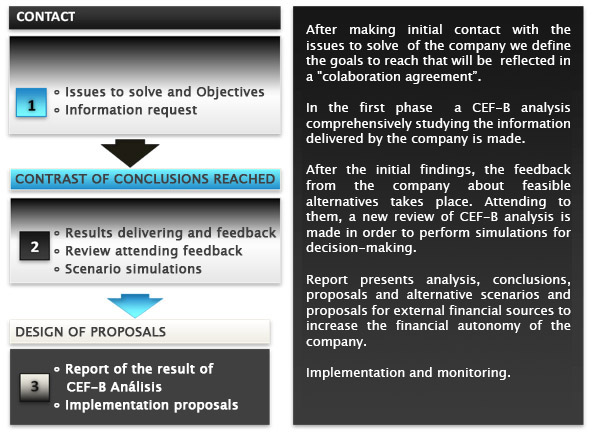

Method OP CorpBanking Advisory:

OP CorpBanking method of Financial Situation Analisis to define the best options to offer to Business companies is based on the performance of CEB Analysis as at time a tool an guideline.